-

General information

-

Account Settings

- Creating & managing your personal doo account

- Organization settings: Managing your account settings

- Multi-user: Working as a team

- How to reset your password

- Changing the email address of your doo account

- The doo account packages

- What can I do if a doo site does not load

- Independently adapt standard designations of the doo booking process

- How do I delete my account

- Payment Process: How to manage payment options

- Password Security using doo: What options are available?

-

Events

-

- Edit email contents

- Using placeholders in booking email templates

- How to adjust invoice contents

- Attendee tickets and QR code scanning

- What do doo tickets look like?

- E-mail attachments for bookers and attendee

- Certificates & Co: Create custom documents

- Define your own booking conditions

- Revenue Disbursement: Entering and editing invoice address & bank account information

- Create bilingual (multilingual) events

- Bookings with manual approval

- Create a waiting list

- Access codes and promotion codes: Discounted tickets for your participants

- doo Widgets: Integration into your own website

- doo Default Event Website and Custom Event Website

- How to create a booking process in english

- Providing flyers, event programs or direction sketches

- How does the booking process work for my attendees?

- How do I make test bookings?

- Creating exclusive registration access for selected contacts

- Delete ticket categories & change prices and sales periods after go-live

- Cancellation of events

- What are event fields and how do I use them best ?

- Shorten the booking process and prefill data: How to make the booking process as convenient as possible for bookers

- Tips for virtual events with doo

- Integration into your own Facebook page

- Event Templates: Creating templates for your events

-

Manage Bookings

- Manage bookings and attendees

- Monitoring incoming bookings

- The attendee overview

- Invitation list: Track the registration status of specific contacts

- Manual registration

- Resend automatically generated emails

- Rebooking: How to change existing bookings

- Cancellation & Refund Handling

- Booking self-service: Allow bookers to subsequently access and edit their bookings

- Download booking overview and attendee list

- Change of attendee data and invoice address

- Bank transfer: How to deal with pending transactions

- What to do, if someone has not received their confirmation e-mail or ticket

-

Contact Management

- Contacts: Introduction and Topic Overview

- Contact details: Collect cross-event contact information

- Overview contact data fields

- Managing contact data fields

- Creating contacts - How do contacts get into the doo contact center?

- Contact import - Bulk creation and editing of contacts

- Managing existing contacts

- Creating and managing contact groups

- Datamatching & Synchronization of booking data and doo contact

- Email subscriptions: Double opt-in & opt-out options at doo

- Deleting contacts

-

Emails

-

Websites

- The doo website editor: create an individual event page

- Mobile optimization: Customize your site for all your devices

- Installing different tracking tools on the website

- Creating a SSL certificat (HTTPS) to ensure data security

- Website Tracking: How to integrate doo into your Google Analytics To be Created

-

Additional Functions

- Optional Service: Refund handling via doo

- Ticket design: How to get your ticket in the desired design

- Forms - Set up surveys and feedback requests for your attendees

- Embedded Reports

- Customer specific sender emails

- Email inbox: How to manage email requests from your participants within doo

- Add calendar entries to your event communication

- Filtered cross-event widgets: How to show only selected events

-

Automations

-

Booker & Attendee FAQ

-

On-Site and Attendance

What do I have to consider regarding VAT?

In step 2 of the event creation “Tickets” you can define all VAT related details for your event. All information about this step and how to navigate there can be found in this article.

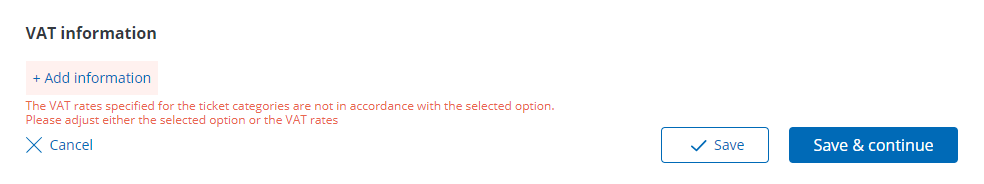

You have the option to show a separate VAT rate for each ticket category. The VAT rates of the booked categories will be listed in the booker invoices with indication of your VAT ID. After you have specified the individual VAT rates when creating your ticket categories, you still need to store the general VAT information for your event. To do this, please scroll to the bottom of the page and click on “Add details” under “VAT information”.

Now you can define the event type:

- Private event: in this case only a VAT rate of 0% can be deposited

- Subject to VAT: in this case, for example, 7% or 19% can be deposited for your ticket categories – 0% is not possible

- Exempt from VAT: in this case, categories with 0% as well as categories with, for example, 7% or 19% can be created. When selecting this event type, you will automatically be asked for an exemption reason, which must be printed on your bookers’ invoices for legal reasons.

In case of VAT liability or exemption, a VAT ID number (VAT ID) must be stored in the revenue disbursement settings or your event. You can find all information here. The specification of the ID is necessary for correct invoicing, therefore an event can only go live after it has been provided. If you do not have a VAT number, you can alternatively enter your tax number.